1 | Equity Fund (HK & China) | 211,552 | 18.55% |

2 | Money Market Fund (MPF Conservative Fund) | 130,132 | 11.41% |

3 | Equity Fund (Global) | 115,934 | 10.16% |

4 | Mixed Asset Fund (81-100% Equity) | 104,796 | 9.19% |

5 | Equity Fund (US) | 82,180 | 7.20% |

6 | Mixed Asset Fund (61-80% Equity) | 82,132 | 7.20% |

7 | Default Investment Strategy Fund (Core Accumulation Fund) | 81,627 | 7.16% |

8 | Guaranteed Fund | 70,026 | 6.14% |

9 | Equity Fund (Asia) | 62,083 | 5.44% |

10 | Mixed Asset Fund (41-60% Equity) | 45,436 | 3.98% |

11 | Bond Fund | 42,619 | 3.74% |

12 | Mixed Asset Fund (21-40% Equity) | 37,487 | 3.29% |

13 | Default Investment Strategy Fund (Age 65 Plus Fund) | 27,798 | 2.44% |

14 | Equity Fund (Europe) | 19,857 | 1.74% |

15 | Mixed Asset Fund (Target Date | 11,959 | 1.05% |

16 | Mixed Asset Fund (Other) | 9,851 | 0.86% |

17 | Money Market Fund (Non MPF Conservative Fund) | 5,190 | 0.45% |

Total | 1,140,657 | 100% |

qpalzm 發表於 24-3-6 20:27

呢段係咩意思?

"如果成員始終擔心個人不懂管理投資,預設投資策略看來是不錯選擇,自2017年4月1日推出以來,當中的核心累積基金的年率化淨回報為5.5%,而65歲後基金年率化淨回報為1.9%。"

強積金回報頂多只得3.7%!打工仔可以點

yywong200 發表於 24-3-6 20:33

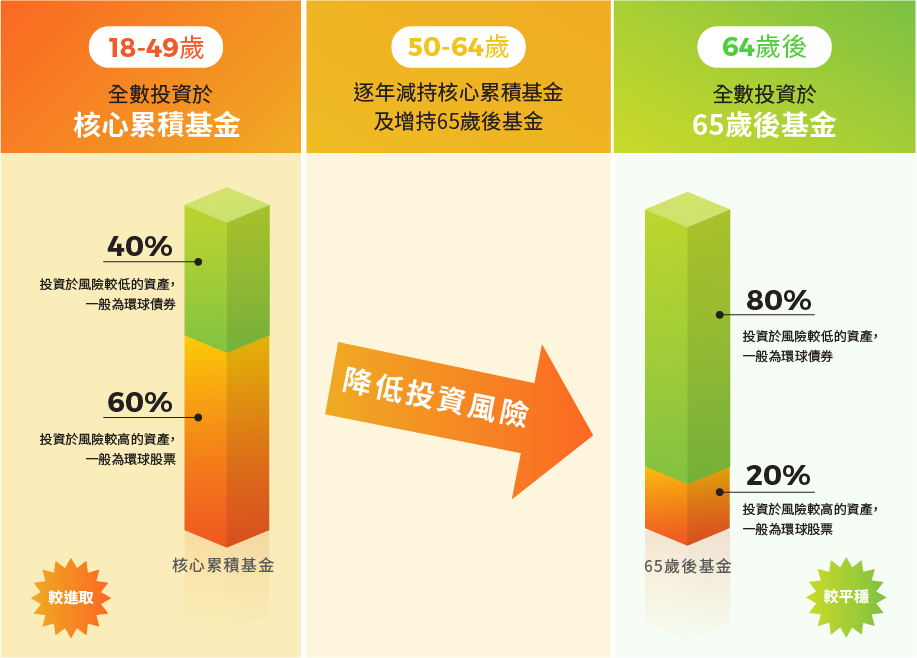

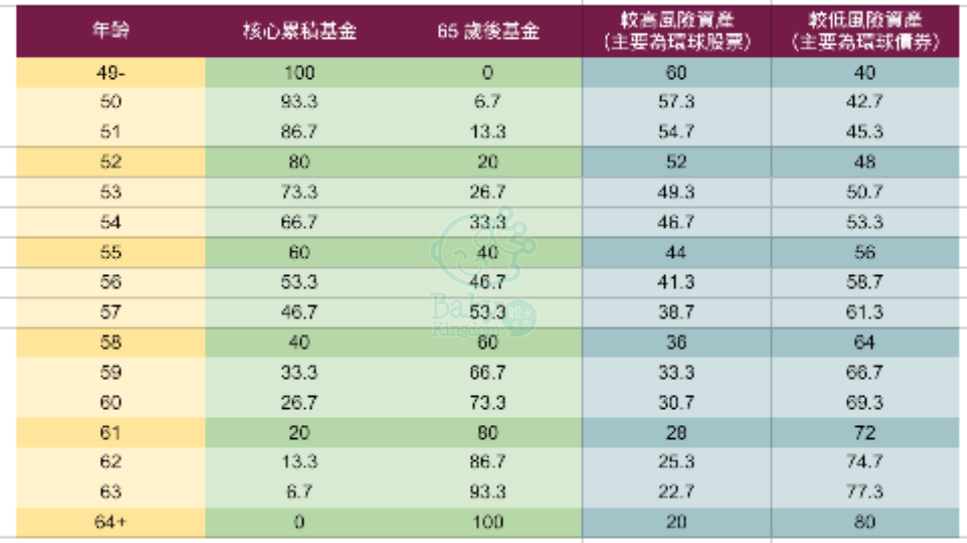

核心累積基金旨在通過環球多元化的投資方式,以取得資本增長。 核心累積基金的目標是把60%的資產淨值投資於較高風險資產(例如環球股票),其餘則投資在較低風險資產(例如環球債務證券、現金及現金等值品,以及《一般規例》下的其他獲准許投資項目)。 因應市場變動,投資於較高風險資產的資產分配可介乎55%至65%之間。

以上為Google(核心累積基金是什麼)答案

即65歲前⋯有六成投資係(較)高風險